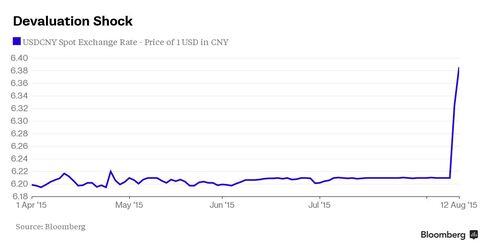

The People's Bank of China intentionally devalued the Yuan in an attempt to (1) increase Chinese exports, which have been lagging recently, and (2) increase reserves in Chinese Banks. Falling below expectations, Chinese exports are essential to that country's economic growth rate - a rate that must be near 10% in order to account for the unusually high level of population growth.

What does this mean for Chinese stocks? The objective of the devaluation is to make Chinese exports cheaper. To the extent that this will occur, Chinese companies could eventually benefit. Alibaba, China's version of Ebay, sure hopes so.

However, there is an unintended consequence. I've been working on a couple of research projects this summer that attempt to determine how instability in currency markets affects the stability of stock prices. In general, I find a direct association between currency volatility and both the volatility of stock prices and the kurtosis of stock prices. These projects, which are in their initial stages, seem to suggest that unstable currencies are related to stock prices that are not only more volatile but prices that also have fatter tails (or prices that have a greater probability of extreme positive and negative movements). This is relatively straightforward. What is not straightforward is determining whether or not currency volatility actually causes stock price volatility and excess kurtosis. To better isolate the direction of causation, I use the exogenous 2005 unpegging of the Yuan as a natural experiment. This identification strategy, which shows that stock price volatility increases surrounding the Yuan's unpegging, suggests that shocks to the stability of currency values indeed cause less stable stock prices. As if Alibaba hasn't experienced enough uncertainty recently, the unintended consequence of the Yuan's intentional devaluation may result in greater volatility in the Chinese stock market - at least in the short run...

No comments:

Post a Comment